Connect Wallet

By connectiong your wallet, you agree to our Teams of Service and our Privacy Policy.

MetaMask

Confirmation

・・・wait・・・

Accessing External Sites

You are about to access an external website from Stable.fish. Please be aware of the following: Stable.fish is not responsible for the content or safety of external sites. Before entering personal information or making transactions, verify the site's credibility and security. If something seems suspicious or you feel uneasy, cease your access and consider consulting with an expert or trusted individual.

Continue to Access

You are about to access an external website from Stable.fish. Please be aware of the following: Stable.fish is not responsible for the content or safety of external sites. Before entering personal information or making transactions, verify the site's credibility and security. If something seems suspicious or you feel uneasy, cease your access and consider consulting with an expert or trusted individual.

・・・

Sturdy

Question

Luxiang

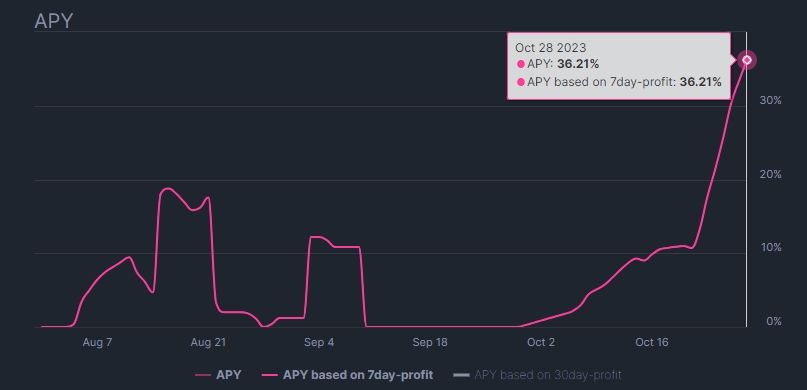

@luxiang · Oct 28, 2023, 08:50

Why is it sometimes a high APY?

For example, on 10/28/2023

For example, on 10/28/2023

3

0

0

Comments (3)

reddigy

@gpe75fish · Oct 29, 2023, 08:34

As the amount of money borrowed (Borrow) gets closer to the total supplied amount (Supply), the Annual Percentage Yield (APY) increases algorithmically.

For instance, as of October 28,

・supply $305K

・borrow $273K (273/305=89%).

This situation means that 89% of the deposited $305K, which equates to $273K, has been lent out, leaving only $32K available in the pool.

Consequently, the protocol elevates the borrow APY to incentivize borrowers to repay their loans sooner.

If the system functions correctly, this mechanism will lead to a reduced utilization rate, and the borrow APY will decrease accordingly.

Tied to these dynamics, the deposit APY will also fluctuate, increasing or decreasing in response to the changing conditions.

For instance, as of October 28,

・supply $305K

・borrow $273K (273/305=89%).

This situation means that 89% of the deposited $305K, which equates to $273K, has been lent out, leaving only $32K available in the pool.

Consequently, the protocol elevates the borrow APY to incentivize borrowers to repay their loans sooner.

If the system functions correctly, this mechanism will lead to a reduced utilization rate, and the borrow APY will decrease accordingly.

Tied to these dynamics, the deposit APY will also fluctuate, increasing or decreasing in response to the changing conditions.

1

1

┏ reddigy - As the amount of money borrowed (Borrow) gets clo…

reddigy - As the amount of money borrowed (Borrow) gets clo…

Zephyr

@zephyr · Oct 30, 2023, 16:02

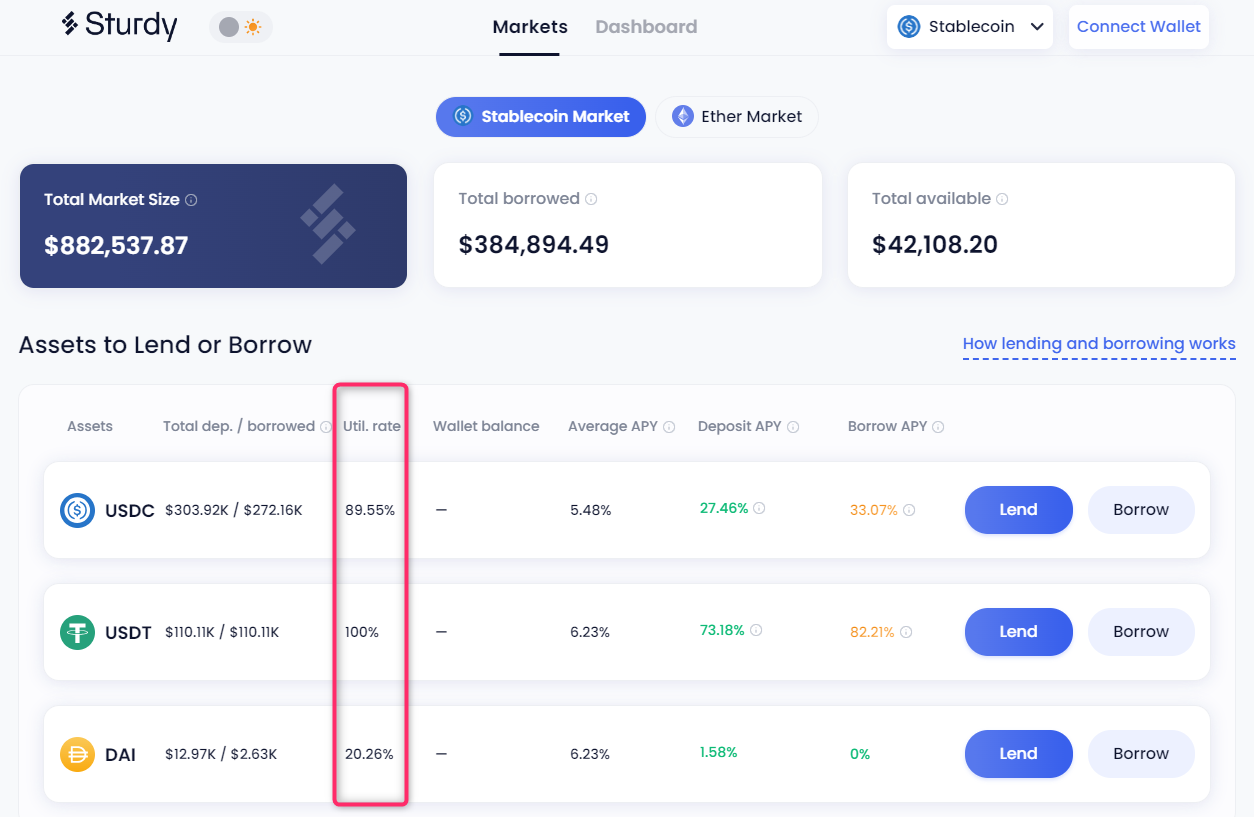

Where can I view utilization rate?

1

1

┏ Zephyr - Where can I view utilization rate?

Zephyr - Where can I view utilization rate?

reddigy

@gpe75fish · Oct 30, 2023, 16:16

You can view utilization rate at Util.rate on Sturdy Markets website.

app.sturdy.finance/markets

app.sturdy.finance/markets

0

1